Treasury Solutions for Confident Capital Strategy

Effective risk management is the cornerstone of success in the ever-evolving realm of corporate finance. GTreasury offers a comprehensive suite of cutting-edge solutions designed to empower treasurers and CFOs to navigate uncertainty with confidence.

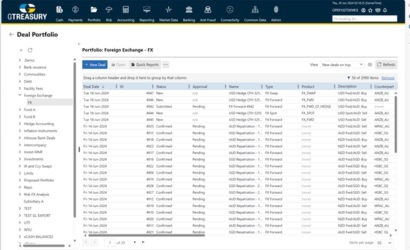

Centralize Deal Management

Centralize Deal Management

Get end-to-end management and control over your financial instruments with a holistic view of your entire portfolio. Become equipped with the tools needed for meticulous control and strategic planning, enabling confident decision-making across the breadth of your financial operations.

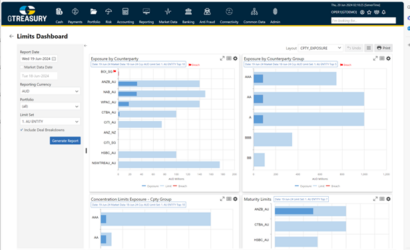

Identify Risk in Any Scenario

Identify Risk in Any Scenario

Explore how our advanced risk management tools, including CFaR and Monte Carlo simulations, can optimize your risk management strategy and debt & investment lifecycle management. Seamlessly visualize, analyze, and address evolving exposures to minimize risk effectively. With our solutions, you can proactively manage risk and respond swiftly to shifting market dynamics, ensuring financial stability and growth.

Mitigate Risk with Confidence

Mitigate Risk with Confidence

Manage earnings volatility from exposure to disclosure with calculations built on sophisticated algorithms and curves that support U.S. hedge accounting standards. Leverage our comprehensive hedge program and team of experts to address interest rate risk, safeguard your company from foreign exchange risk, and mitigate commodity price risk.

Streamline Regulatory Oversight

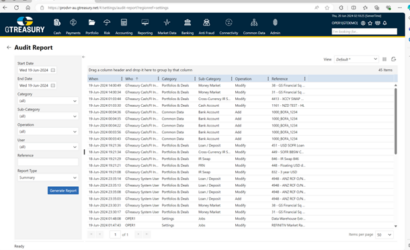

Streamline Regulatory Oversight

Simplify your audit and compliance by ensuring covenant compliance, preventing costly penalties, and offering a comprehensive audit facility. With transparent reporting and built-in audit trails, this solution satisfies auditors and meets SEC requirements effortlessly. Ensure compliance with U.S. & IFRS GAAP, improve SOX controls, and facilitate preparation for audits with established risk.

Learn MoreSeamlessly Integrate Risk Management with Cash Flow Analysis

Streamline your treasury operations with our advanced Treasury Risk Management System. Begin with comprehensive exposure management, where all your exposures are visible in one system. Utilize scenario analysis to apply different models and identify potential risks, ensuring your positions align with trading and hedging policies.

Once risks are identified, you can execute trades seamlessly and perform in-depth analytics on those trades. Manage the entire deal lifecycle within the platform, ensuring precise control over your portfolio.

Integrate effortlessly with your accounting systems to streamline disclosures, valuations, and compliance. Ultimately, you’ll gain unparalleled visibility into your cash flows and settlements, presented clearly on your cash position worksheet. Our system empowers CFOs to make informed, strategic decisions to optimize liquidity and enhance overall financial performance.

Read Our Product Card

![]()

Add World-Class Derivative Specialists to Your Team

Align your hedge accounting with long-term financial goals by adding our derivative experts to your team, ensuring timely and accurate journal entries and disclosures for all your hedges. This way, your team can focus more on core business priorities, like boosting revenue.

Success Story

American Airlines

Webinar

On-Demand Webinar: Lower Your Cost of Capital...

Product Information

Risk Management Fact Sheet

See GTreasury in Action

Get connected with supportive experts, comprehensive solutions, and untapped possibility today.