Risk Management

Master Risk, Strengthen Resilience, Build Financial Confidence

Risk management is the foundation of success in an unpredictable financial landscape. With a full suite of advanced solutions, GTreasury empowers treasurers and CFOs to act decisively, strategize confidently, and steer through uncertainty with precision.

strengthen financial resilience

Benefits of GTreasury Risk Management

Build Financial Resilience

Protect your organization from market volatility with real-time insights that help you anticipate and adapt to change.

Drive Confident Decisions

Make smarter choices with clarity into exposures, cash flow, and complaince, empowering long-term stability and growth.

Optimize Performance

Eliminate inefficiencies, reduce costs, and free resources to focus on strategic initiatives that move the business forward.

Allocate Resources

Free up resources by eliminating repetitive manual tasks in favor of high-value, strategic initiatives.

GTreasury centralizes your risk and cash data to give you complete clarity into exposures

and their impact on cash flow. With real-time visibility, you can track foreign exchange,

interest rate, and credit risks in one place.

AI-driven modeling and automated reporting then help you forecast outcomes, test scenarios, and stay compliant. The results is faster decisions, stronger resilience, and the confidence to act in any market condition.

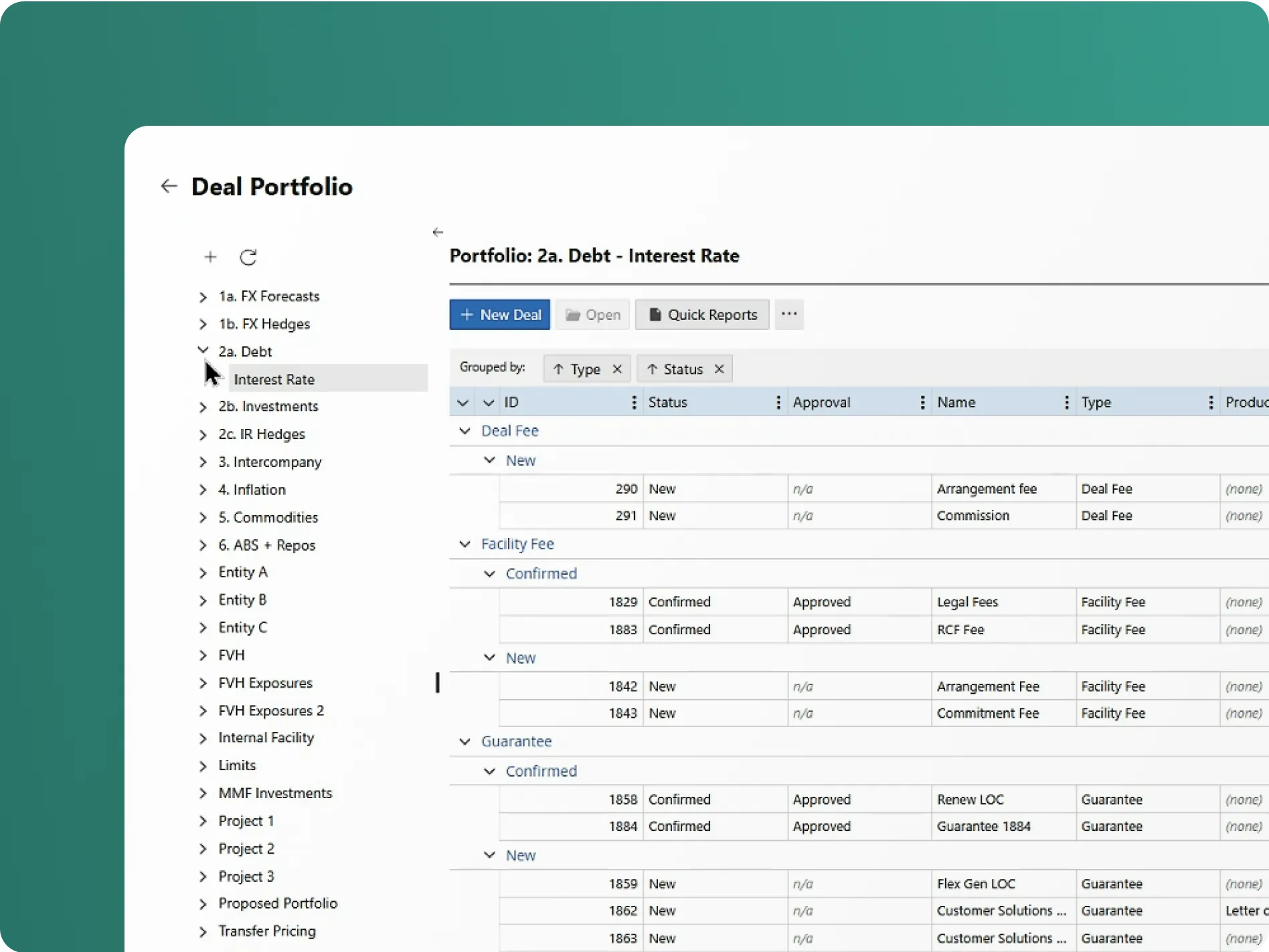

master your portfolio

Centralize Deal Management

Get end-to-end management and control over your financial instruments with a holistic view of your entire portfolio. Become equipped with the tools needed for meticulous control and strategic planning, enabling confident decision-making across the breadth of your financial operations.

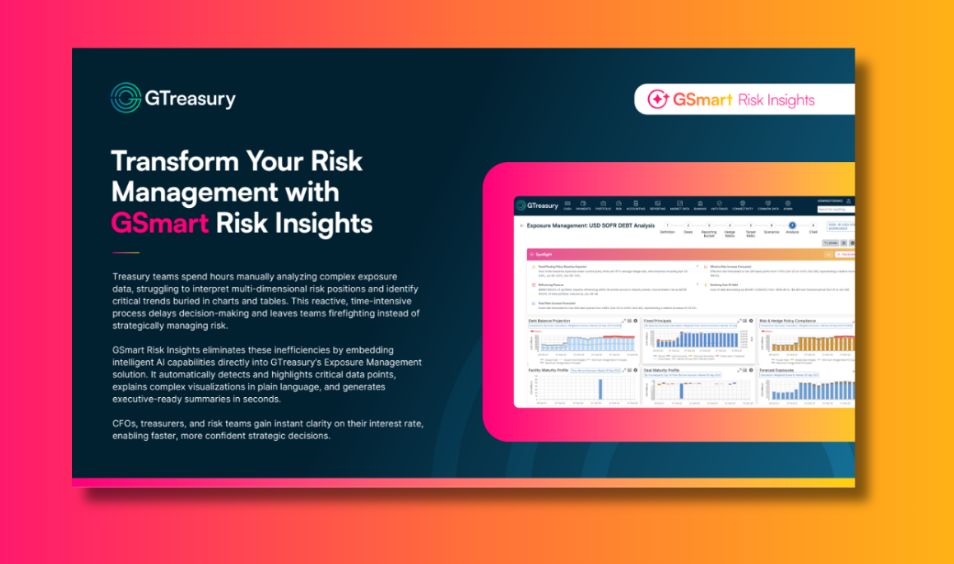

Eliminate Hours of Manual Analysis

Intelligent Risk Insights with GSmart AI

GSmart Risk Insights uses AI to automatically detect and explain critical exposure data, transforming complex charts and multi-dimensional risk positions into clear, actionable intelligence. Treasury teams gain instant visibility into policy breaches, approaching maturities, hedge ratio deviations, and significant cost changes - all explained in plain language with contextual analysis. GSmart AI also powers advanced capabilities like Monte Carlo simulations and Cash Flow-at-Risk (CFaR) modeling for probabilistic risk assessment. By generating executive-ready summaries in seconds and surfacing insights that would otherwise take hours to uncover, GSmart Risk Insights helps you shift from reactive firefighting to proactive, strategic risk optimization.

Hedge Smarter, Protect Faster

Mitigate Risk. Maximize Confidence.

Manage earnings volatility with precise calculations based on U.S. hedge accounting standards. Use our hedge program and expert team to protect against foreign exchange exposure and reduce commodity price risk.

simplify compliance efforts

Effortless Regulatory Management

Prevent costly penalties by ensuring compliance and staying audit-ready. Transparent reporting and built-in audit trails satisfy auditors and meet SEC requirements. Stay compliant with U.S. and IFRS GAAP, strengthen SOX controls, and simplify audit preparation.

Seamlessly Integrate Risk Management with Cash Flow Analysis

derivatives made simple

Master Derivatives with Expert Help

Align your hedge accounting with long-term financial goals with the help of our derivative experts. They ensure timely, accurate journal entries and disclosures for all your hedges. This lets your team focus on core priorities, like growing revenue.

Real Results in Risk Management

Bruker transformed its treasury operations with GTreasury, moving from manual, fragmented processes to an automated system that reduces risk and improves decision-making.

- Full FX Exposure Hedged: Affiliate-level risks are neutralized, stabilizing P&L and reducing volatility.

-

- Centralized, Scalable Platform: Eliminates spreadsheets, disparate portals, and manual processes for cash and risk management.

-

- Faster, Smarter Operations: Streamlined documentation, compliance, and forecasting.

-

With GTreasury, Bruker’s treasury team gained clarity, consistency, and control, building a strong foundation for future growth.

Who Benefits from GTreasury Risk Management?

- CFOs: Gain clarity and control to make strategic, confident decisions that drive growth and protect the organization.

-

- Treasurers: Monitor exposures, manage liquidity, and optimize hedging with real-time insights and AI-powered analytics.

-

- Controllers: Simplify reporting, ensure compliance, and automate manual tasks to maintain accurate records and support audits.

gain insights into managing risk

Learn How to Improve Your Bottom Line and Create Cash Flow Certainty

Download this comprehensive overview today.

Feature

Spreadsheet Risk Management

GTreasury Risk Management

See GTreasury in Action

Get connected with supportive experts, comprehensive solutions, and untapped possibility today.

.png)

.png)

.png)

.png)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpg)

.jpg)

.jpg)