What is FX Risk?

FX risk, or foreign exchange risk, is the exposure a company faces due to fluctuations in currency exchange rates. It arises when transactions occur in different currencies, impacting earnings and financial stability. Effective FX risk management is crucial for businesses engaging in international trade or having operations across borders.

Unmanaged FX risk can lead to significant financial losses, affecting earnings per share (EPS) and overall profitability. Implementing robust FX risk management strategies, such as balance sheet exposure management and cash flow exposure forecasting, is essential to navigate these fluctuations. By proactively managing FX risk, companies can safeguard their financial health and optimize their financial performance.

What are the Different Types of FX Risk Management?

Transaction Risk

Transaction risk, also known as currency risk, occurs when the exchange rate changes between the transaction date and the settlement date. Businesses engaging in international trade, where payments and receipts are in foreign currencies, face transaction risk. If the currency weakens between agreeing on a deal and settling it, the business might incur losses. Transaction risk can impact both payables and receivables, affecting the company’s profitability and cash flow.

Translation or Accounting Risk

Translation risk, also referred to as accounting risk, arises when a company’s financial statements are translated from one currency to another for reporting purposes. This risk is common for multinational corporations with subsidiaries in different countries. Fluctuations in exchange rates can lead to variations in the translated values of assets, liabilities, revenues, and expenses. These changes can affect key financial metrics and ratios, impacting how investors and stakeholders perceive the company’s financial health. To manage translation risk, companies often use translation exposure management strategies to minimize the impact of currency fluctuations on their financial statements.

Economic Risk

Economic risk, also known as economic exposure or operating exposure, is the risk that arises from the effect of exchange rate fluctuations on a company’s future cash flows and market value. Unlike transaction risk, economic risk considers long-term impacts. It can result from changes in exchange rates, interest rates, inflation rates, and other macroeconomic factors. Economic risk is particularly relevant for companies with significant international operations, as it can influence their competitive position, market demand, and production costs. Mitigating economic risk requires strategic planning, diversification of markets, and the use of financial derivatives to hedge against potential adverse movements in exchange rates.

Liquidity Risk

Liquidity risk in the context of FX management refers to a company’s ability to meet its financial obligations in the face of unpredictable currency fluctuations. If a company cannot absorb FX volatility effectively, it might struggle to pay bills, service loans, make payments to suppliers, or run its operations smoothly. This risk can disrupt day-to-day operations and lead to financial distress. Liquidity risk management involves ensuring that a company maintains adequate reserves and flexibility in its cash flow planning to accommodate FX volatility. It often requires a careful balance between short-term liquidity needs and long-term financial stability, ensuring the company’s ability to navigate currency fluctuations without significant disruptions.

Understanding and managing these various types of FX risk are essential for businesses operating in the global marketplace. Implementing robust risk management strategies tailored to each type of risk can help companies navigate the complexities of foreign exchange fluctuations and ensure their financial stability and long-term success.

How to Mitigate FX Risk

To avoid impacts to earnings, organizations must work to manage their FX exposure and risks. Organizations can reduce FX risk by organically eliminating exposures internally or by hedging exposures through balance sheet exposure management and cash flow exposure forecasting.

Balance Sheet Exposure Management

Balance sheet exposure management is a strategic approach used in foreign exchange (FX) risk management. It involves assessing and managing the currency exposure arising from a company’s assets and liabilities. In essence, it focuses on understanding how changes in exchange rates can impact a company’s financial position.

In the realm of FX risk management, understanding balance sheet exposure is crucial. By identifying assets and liabilities susceptible to currency fluctuations, companies can proactively implement hedging strategies to mitigate potential losses. For instance, if a company has substantial foreign currency payables, a decrease in the home currency’s value can lead to higher repayment costs. By managing this exposure, companies can safeguard their financial stability.

Benefits of Balance Sheet Exposure Management:

- Risk Reduction: By identifying and managing balance sheet exposures, companies can significantly reduce their vulnerability to adverse currency movements. This proactive approach minimizes the impact of FX fluctuations on financial performance.

- Improved Financial Planning: Clear insights into balance sheet exposure enable businesses to incorporate FX risk into their financial planning processes. Accurate forecasting becomes possible, aiding in budgeting and strategic decision-making.

- Enhanced Stakeholder Confidence: Effective balance sheet exposure management demonstrates prudent financial stewardship. Stakeholders, including investors and creditors, gain confidence in the company’s ability to navigate currency risks, enhancing overall trust and credibility.

- Optimized Hedging Strategies: Understanding balance sheet exposure allows companies to tailor their hedging strategies. By focusing on specific exposures, businesses can choose appropriate hedging instruments, maximizing effectiveness while minimizing costs.

- Mitigated Earnings Volatility: By managing balance sheet exposures, companies can stabilize their earnings, reducing volatility caused by unpredictable currency movements. This stability contributes to consistent financial performance over time.

Cash Flow Exposure Forecasting

Cash flow exposure forecasting is a vital aspect of foreign exchange (FX) risk management. It involves predicting how changes in currency exchange rates might impact a company’s future cash flows. By analyzing anticipated transactions and cash flows denominated in foreign currencies, businesses can identify potential vulnerabilities and plan appropriate hedging strategies.

In the realm of FX risk management, cash flow exposure forecasting is fundamental. It provides insights into the timing and magnitude of currency-related cash flow risks. Companies can use this information to implement targeted hedging measures, ensuring that they can meet their financial obligations and protect profitability, even amidst fluctuating exchange rates.

Benefits of Cash Flow Exposure Forecasting:

- Strategic Decision Making: Accurate cash flow exposure forecasting allows businesses to make informed strategic decisions. By understanding the impact of FX fluctuations on cash flows, companies can align their operational and investment activities with prevailing market conditions.

- Effective Hedging Strategies: Cash flow exposure forecasting enables companies to select appropriate hedging instruments and time their hedging activities effectively. This precision ensures that hedges are tailored to specific currency risks, optimizing their effectiveness in mitigating potential losses.

- Budgeting Accuracy: By incorporating cash flow exposure forecasts into budgeting processes, businesses enhance the accuracy of their financial projections. This accuracy is essential for planning and resource allocation, aligning budgetary goals with anticipated FX risks.

- Reduced Volatility: Anticipating cash flow exposure helps in reducing earnings volatility caused by unexpected currency fluctuations. This stability in financial performance enhances investor confidence and supports consistent dividend payouts, contributing to a positive market perception.

- Enhanced Cash Management: Cash flow exposure forecasting facilitates proactive cash management. Companies can ensure they have adequate liquidity to cover FX-related obligations, reducing the risk of liquidity shortages and associated financial challenges.

Hedging Strategies for Managing Currency and FX Risk

Hedging strategies are essential tools for businesses looking to mitigate currency and foreign exchange (FX) risks. These strategies help companies protect themselves from adverse movements in exchange rates, ensuring financial stability and predictability. Here are three common hedging instruments:

Futures Contracts

Futures contracts are standardized agreements between two parties to buy or sell an asset at a predetermined price on a specified future date. In the context of currency hedging, futures contracts allow companies to lock in exchange rates for future transactions. For instance, if a business anticipates needing a specific amount of foreign currency in the future, it can use a futures contract to secure the current exchange rate, mitigating the risk of unfavorable rate movements. While futures contracts provide certainty, they also come with an obligation to execute the contract regardless of the prevailing market rate.

Forward Contracts

Forward contracts are customized agreements between two parties to buy or sell an asset at a specific price on a future date. Unlike futures contracts, forward contracts are tailored to meet the specific requirements of the parties involved. These contracts allow businesses to hedge against future currency fluctuations by locking in a predetermined exchange rate. Forward contracts are advantageous for their flexibility, as the terms can be customized based on the company’s needs. However, they are traded over-the-counter, posing potential counterparty risk, and are not as standardized or regulated as futures contracts.

Options

Options are financial derivatives that give the holder the right, but not the obligation, to buy (call option) or sell (put option) an asset at a predetermined price within a specified period. Options provide flexibility for companies facing uncertain currency movements. Call options allow businesses to benefit from favorable currency movements, while put options protect against adverse movements. Unlike futures and forward contracts, options offer the advantage of limited risk, as the holder is not obligated to execute the contract if market conditions are unfavorable. However, options come with a premium cost, which represents the maximum potential loss.

GTreasury and FX and Currency Risk Management

GTreasury revolutionizes FX and currency risk management with its cutting-edge features. By providing real-time access to global market data, GTreasury enables businesses to make timely decisions based on the latest exchange rates and currency valuations. The system automates exposure identification, capturing transactional data in multiple currencies and ensuring no exposure goes unnoticed. Robust scenario analysis and modeling tools empower treasury teams to simulate various scenarios, aiding in effective hedging strategies and risk mitigation plans.

GTreasury simplifies hedge management, allowing treasurers to execute and monitor contracts seamlessly while ensuring compliance with accounting standards. The system generates detailed reports on FX exposures, hedges, and performance metrics, enhancing transparency and aiding in regulatory compliance. With seamless integration capabilities, GTreasury consolidates financial data from multiple sources, providing a unified view for accurate risk assessment. Scalable and customizable, GTreasury adapts to businesses of all sizes, enabling them to manage currency risks with confidence and precision.

What is FX Risk?

FX risk, or foreign exchange risk, is the exposure a company faces due to fluctuations in currency exchange rates. It arises when transactions occur in different currencies, impacting earnings and financial stability. Effective FX risk management is crucial for businesses engaging in international trade or having operations across borders.

Unmanaged FX risk can lead to significant financial losses, affecting earnings per share (EPS) and overall profitability. Implementing robust FX risk management strategies, such as balance sheet exposure management and cash flow exposure forecasting, is essential to navigate these fluctuations. By proactively managing FX risk, companies can safeguard their financial health and optimize their financial performance.

What are the Different Types of FX Risk Management?

Transaction Risk

Transaction risk, also known as currency risk, occurs when the exchange rate changes between the transaction date and the settlement date. Businesses engaging in international trade, where payments and receipts are in foreign currencies, face transaction risk. If the currency weakens between agreeing on a deal and settling it, the business might incur losses. Transaction risk can impact both payables and receivables, affecting the company’s profitability and cash flow.

Translation or Accounting Risk

Translation risk, also referred to as accounting risk, arises when a company’s financial statements are translated from one currency to another for reporting purposes. This risk is common for multinational corporations with subsidiaries in different countries. Fluctuations in exchange rates can lead to variations in the translated values of assets, liabilities, revenues, and expenses. These changes can affect key financial metrics and ratios, impacting how investors and stakeholders perceive the company’s financial health. To manage translation risk, companies often use translation exposure management strategies to minimize the impact of currency fluctuations on their financial statements.

Economic Risk

Economic risk, also known as economic exposure or operating exposure, is the risk that arises from the effect of exchange rate fluctuations on a company’s future cash flows and market value. Unlike transaction risk, economic risk considers long-term impacts. It can result from changes in exchange rates, interest rates, inflation rates, and other macroeconomic factors. Economic risk is particularly relevant for companies with significant international operations, as it can influence their competitive position, market demand, and production costs. Mitigating economic risk requires strategic planning, diversification of markets, and the use of financial derivatives to hedge against potential adverse movements in exchange rates.

Liquidity Risk

Liquidity risk in the context of FX management refers to a company’s ability to meet its financial obligations in the face of unpredictable currency fluctuations. If a company cannot absorb FX volatility effectively, it might struggle to pay bills, service loans, make payments to suppliers, or run its operations smoothly. This risk can disrupt day-to-day operations and lead to financial distress. Liquidity risk management involves ensuring that a company maintains adequate reserves and flexibility in its cash flow planning to accommodate FX volatility. It often requires a careful balance between short-term liquidity needs and long-term financial stability, ensuring the company’s ability to navigate currency fluctuations without significant disruptions.

Understanding and managing these various types of FX risk are essential for businesses operating in the global marketplace. Implementing robust risk management strategies tailored to each type of risk can help companies navigate the complexities of foreign exchange fluctuations and ensure their financial stability and long-term success.

How to Mitigate FX Risk

To avoid impacts to earnings, organizations must work to manage their FX exposure and risks. Organizations can reduce FX risk by organically eliminating exposures internally or by hedging exposures through balance sheet exposure management and cash flow exposure forecasting.

Balance Sheet Exposure Management

Balance sheet exposure management is a strategic approach used in foreign exchange (FX) risk management. It involves assessing and managing the currency exposure arising from a company’s assets and liabilities. In essence, it focuses on understanding how changes in exchange rates can impact a company’s financial position.

In the realm of FX risk management, understanding balance sheet exposure is crucial. By identifying assets and liabilities susceptible to currency fluctuations, companies can proactively implement hedging strategies to mitigate potential losses. For instance, if a company has substantial foreign currency payables, a decrease in the home currency’s value can lead to higher repayment costs. By managing this exposure, companies can safeguard their financial stability.

Benefits of Balance Sheet Exposure Management:

- Risk Reduction: By identifying and managing balance sheet exposures, companies can significantly reduce their vulnerability to adverse currency movements. This proactive approach minimizes the impact of FX fluctuations on financial performance.

- Improved Financial Planning: Clear insights into balance sheet exposure enable businesses to incorporate FX risk into their financial planning processes. Accurate forecasting becomes possible, aiding in budgeting and strategic decision-making.

- Enhanced Stakeholder Confidence: Effective balance sheet exposure management demonstrates prudent financial stewardship. Stakeholders, including investors and creditors, gain confidence in the company’s ability to navigate currency risks, enhancing overall trust and credibility.

- Optimized Hedging Strategies: Understanding balance sheet exposure allows companies to tailor their hedging strategies. By focusing on specific exposures, businesses can choose appropriate hedging instruments, maximizing effectiveness while minimizing costs.

- Mitigated Earnings Volatility: By managing balance sheet exposures, companies can stabilize their earnings, reducing volatility caused by unpredictable currency movements. This stability contributes to consistent financial performance over time.

Cash Flow Exposure Forecasting

Cash flow exposure forecasting is a vital aspect of foreign exchange (FX) risk management. It involves predicting how changes in currency exchange rates might impact a company’s future cash flows. By analyzing anticipated transactions and cash flows denominated in foreign currencies, businesses can identify potential vulnerabilities and plan appropriate hedging strategies.

In the realm of FX risk management, cash flow exposure forecasting is fundamental. It provides insights into the timing and magnitude of currency-related cash flow risks. Companies can use this information to implement targeted hedging measures, ensuring that they can meet their financial obligations and protect profitability, even amidst fluctuating exchange rates.

Benefits of Cash Flow Exposure Forecasting:

- Strategic Decision Making: Accurate cash flow exposure forecasting allows businesses to make informed strategic decisions. By understanding the impact of FX fluctuations on cash flows, companies can align their operational and investment activities with prevailing market conditions.

- Effective Hedging Strategies: Cash flow exposure forecasting enables companies to select appropriate hedging instruments and time their hedging activities effectively. This precision ensures that hedges are tailored to specific currency risks, optimizing their effectiveness in mitigating potential losses.

- Budgeting Accuracy: By incorporating cash flow exposure forecasts into budgeting processes, businesses enhance the accuracy of their financial projections. This accuracy is essential for planning and resource allocation, aligning budgetary goals with anticipated FX risks.

- Reduced Volatility: Anticipating cash flow exposure helps in reducing earnings volatility caused by unexpected currency fluctuations. This stability in financial performance enhances investor confidence and supports consistent dividend payouts, contributing to a positive market perception.

- Enhanced Cash Management: Cash flow exposure forecasting facilitates proactive cash management. Companies can ensure they have adequate liquidity to cover FX-related obligations, reducing the risk of liquidity shortages and associated financial challenges.

Hedging Strategies for Managing Currency and FX Risk

Hedging strategies are essential tools for businesses looking to mitigate currency and foreign exchange (FX) risks. These strategies help companies protect themselves from adverse movements in exchange rates, ensuring financial stability and predictability. Here are three common hedging instruments:

Futures Contracts

Futures contracts are standardized agreements between two parties to buy or sell an asset at a predetermined price on a specified future date. In the context of currency hedging, futures contracts allow companies to lock in exchange rates for future transactions. For instance, if a business anticipates needing a specific amount of foreign currency in the future, it can use a futures contract to secure the current exchange rate, mitigating the risk of unfavorable rate movements. While futures contracts provide certainty, they also come with an obligation to execute the contract regardless of the prevailing market rate.

Forward Contracts

Forward contracts are customized agreements between two parties to buy or sell an asset at a specific price on a future date. Unlike futures contracts, forward contracts are tailored to meet the specific requirements of the parties involved. These contracts allow businesses to hedge against future currency fluctuations by locking in a predetermined exchange rate. Forward contracts are advantageous for their flexibility, as the terms can be customized based on the company’s needs. However, they are traded over-the-counter, posing potential counterparty risk, and are not as standardized or regulated as futures contracts.

Options

Options are financial derivatives that give the holder the right, but not the obligation, to buy (call option) or sell (put option) an asset at a predetermined price within a specified period. Options provide flexibility for companies facing uncertain currency movements. Call options allow businesses to benefit from favorable currency movements, while put options protect against adverse movements. Unlike futures and forward contracts, options offer the advantage of limited risk, as the holder is not obligated to execute the contract if market conditions are unfavorable. However, options come with a premium cost, which represents the maximum potential loss.

GTreasury and FX and Currency Risk Management

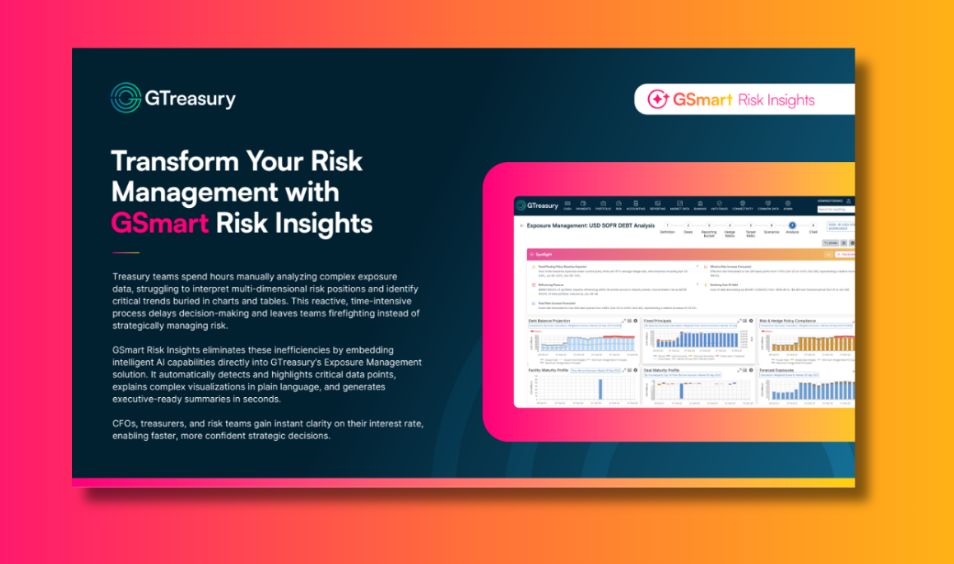

GTreasury revolutionizes FX and currency risk management with its cutting-edge features. By providing real-time access to global market data, GTreasury enables businesses to make timely decisions based on the latest exchange rates and currency valuations. The system automates exposure identification, capturing transactional data in multiple currencies and ensuring no exposure goes unnoticed. Robust scenario analysis and modeling tools empower treasury teams to simulate various scenarios, aiding in effective hedging strategies and risk mitigation plans.

GTreasury simplifies hedge management, allowing treasurers to execute and monitor contracts seamlessly while ensuring compliance with accounting standards. The system generates detailed reports on FX exposures, hedges, and performance metrics, enhancing transparency and aiding in regulatory compliance. With seamless integration capabilities, GTreasury consolidates financial data from multiple sources, providing a unified view for accurate risk assessment. Scalable and customizable, GTreasury adapts to businesses of all sizes, enabling them to manage currency risks with confidence and precision.

See GTreasury in Action

Get connected with supportive experts, comprehensive solutions, and untapped possibility today.

.png)

.png)

.png)

.png)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpeg)

.jpg)

.jpg)

.jpg)