Achieve The Clarity to Act with the leading treasury platform enhanced by enterprise-grade infrastructure. Gain tangible optionality between traditional and digital rails and maintain what works while accessing 24/7 liquidity, cost savings, and accelerated innovation. Our solutions adapt to your business, delivering cash visibility and forecasting in 90 days.

The World’s Most Adaptable Treasury Platform

Cash Visibility

Connected Banks

Payments Volume

artificial intelligence

GSmart AI: Amplified Treasury Solutions

Remove Toil and Inefficiencies

See and Solve Problems Faster

Faster Time-to-Insights

All from Secure and Accurate Data

Flexible treasury solutions that evolve with you

Solutions for Today’s Needs, Adaptable for Tomorrow’s

Designed for every stage of treasury complexity.

90% of CFOs state Cash Visibility as their #1 concern.

Be up and running in 90 days with Cash Visibility and Cash Forecasting.

OUR SOLUTIONS

Discover How We Help CFOs and Treasury Teams

Total Cash Visibility

Gain comprehensive visibility into your global cash positions, ensuring optimal liquidity management across all accounts and entities.

Effective Cash Flow Forecasting

Achieve precise, real-time cash forecasts that empower you to make informed financial decisions and avoid costly surprises.

Enhance Capital Efficiency

Maximize returns and minimize risk by efficiently managing debt and investment portfolios with real-time insights, empowering CFOs to make informed, strategic decisions.

Assess and Mitigate Risk

Mitigate exposure to foreign exchange and interest rate risks with integrated hedging strategies that safeguard your balance sheet.

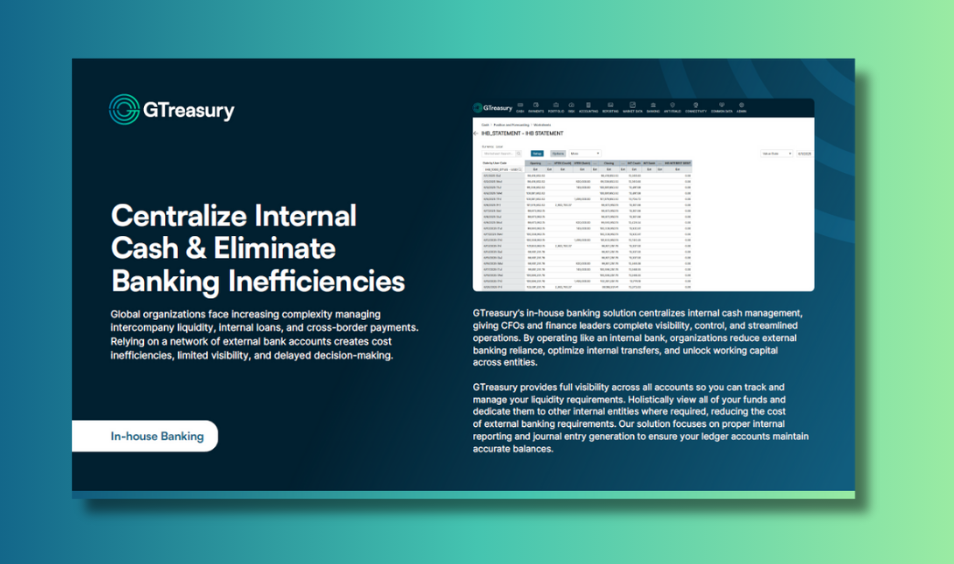

Reduce Costs with Netting

Streamline your cash flow with automated netting processes that minimize transaction costs and enhance efficiency.

Streamline Payments

Automate and centralize your payment processes to reduce manual errors, enhance security, and drive efficiency across your entire organization.

Complete Treasury Management System

Designed for every stage of treasury complexity.

Be up and running in 90 days with Cash Visibility and Cash Forecasting. Because optimizing liquidity can’t wait.

of CFOs state Cash Visibility as their #1 concern.

Our clients have more to say than we do!

“We should have done this earlier,” said Eveline. “It’s been smarter. I can go in there (into CashAnalytics) and see the clients that are paying, and that’s really nice to have in one place.”

First Last

Position, BearingPoint

“We should have done this earlier,” said Eveline. “It’s been smarter. I can go in there (into CashAnalytics) and see the clients that are paying, and that’s really nice to have in one place.”

First Last

Position, BearingPoint

.svg)

“We should have done this earlier,” said Eveline. “It’s been smarter. I can go in there (into CashAnalytics) and see the clients that are paying, and that’s really nice to have in one place.”

First Last

Position, BearingPoint

“We should have done this earlier,” said Eveline. “It’s been smarter. I can go in there (into CashAnalytics) and see the clients that are paying, and that’s really nice to have in one place.”

First Last

Position, BearingPoint

“We should have done this earlier,” said Eveline. “It’s been smarter. I can go in there (into CashAnalytics) and see the clients that are paying, and that’s really nice to have in one place.”

First Last

Position, BearingPoint

Your Success is Our Priority

Expertise and Support—We Do the Hard Work for You.

As the global industry leader in Treasury solutions, Ripple Treasury, powered by GTreasury, provides you with unmatched expertise and ensures your continued success through dedicated guidance and top-tier support.

Customer Support that places your success front and center.

See GTreasury in Action

Get connected with supportive experts, comprehensive solutions, and untapped possibility today.

.jpeg)

.jpg)

.png)

.jpg)

.jpeg)

.png)

.jpg)

.jpeg)

.png)

.png)

.jpg)