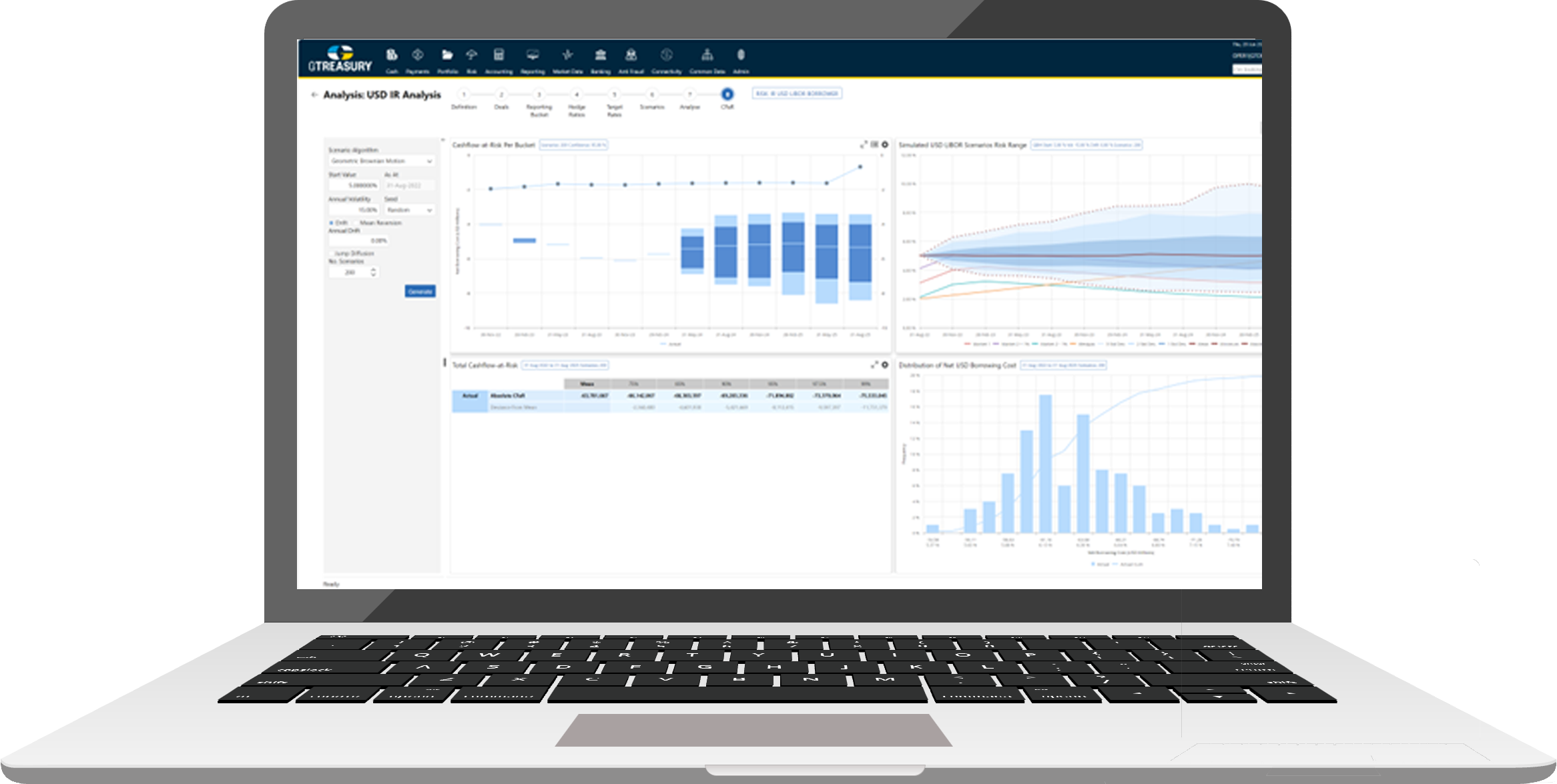

Make Informed Decisions with Accurate Risk Insights

Our risk management solution gives you full visibility into your financial metrics against your risk policy so you can make informed business decisions. From reporting your debt profile or performing deeper analysis to assess your Cash Flow at Risk (CFaR), you can monitor changes in risk exposure in real time.

| Advanced Instrument Library | Report Policy Compliance | Superior Market Risk Analysis |

|

|

|

“

”

GTreasury was able to handle our complex account structure… The worksheets are flexible and give us the ability to add, move or remove accounts in real-time.

Cheryl Kavka

Manager of Corporate Banking, Prudential

Success Story

A Single Solution: The Foundation for Growth

A regulatory review of Secure Trust Bank’s practices prompted the implementation of a robust system to automate their treasury operations.

Read

Want to Learn More?

Download a comprehensive overview of Risk Management to see how it works in the larger GTreasury platform.

See GTreasury in action

Get connected with supportive experts, comprehensive solutions and untapped possibility today.